Loan demand strong at Marine Bank & Trust — Melbourne branch set to expand to accommodate growth; marks 25th year as a community bank

By Ken Datzman

Marine Bank & Trust, based in Vero Beach with a full– service branch in Melbourne, has been growing and producing the kind of numbers that make shareholders happy.

The bank has seen strong asset growth, record earnings, and profitability. In fact, its assets have surged, from $287 million on Jan. 1, 2020, to more than $545 million today.

“We have grown throughout the pandemic,” said Lory Milton, vice president, commercial loan officer at Marine Bank & Trust branch on Suntree Boulevard.

“But the most important thing is we are a true community bank at heart. Our doors are open. People are coming through our doors. It’s exciting to see familiar faces again. Business is thriving. The year has gotten off to a great start for us. We’ve already had multiple commercial loan closings. It’s a good time to be working as a lender.”

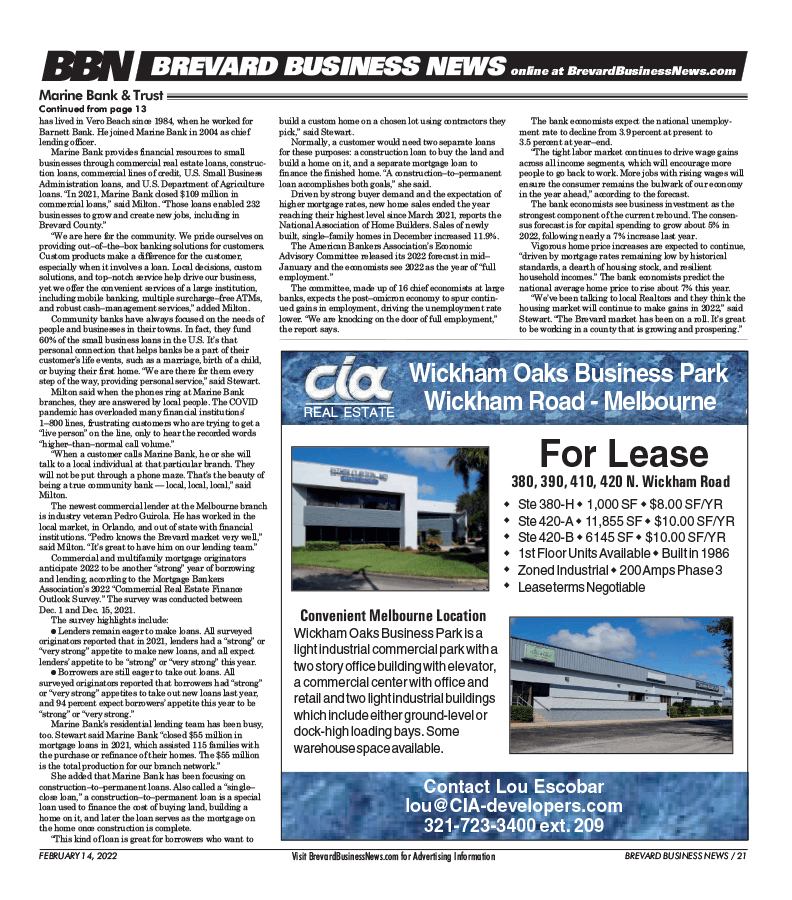

Typically, income from commercial real estate loans is the revenue stream that drives profitability for community banks. And Marine Bank is seeing strong lending demand. “Just drive up and down Wickham Road in Melbourne, new construction seems to be everywhere,” she said.

To accommodate its growing number of lenders and to gear up for 2022, Marine Bank is converting space and adding two offices at its Melbourne branch, which is managed by Charlie McCoach. The construction project is set for March.

Marine Bank expanded into Brevard County with the opening of the Melbourne branch four years ago.

“We have been well received in the community. The growth has been exciting. Our lending team is growing. We now have four lenders — two on the commercial side and two on the residential side,” said Dianna Stewart, a residential loan officer at the Melbourne location.

She added, “With all the job growth in the area and new residents moving here, I believe the housing market will continue to make gains in 2022. Last year home sales were strong, here and around the state.”

There were more than 528,000 total sales of existing homes in Florida in 2021 — an increase of 19% over 2020’s total, according to Florida Realtors’ research department in partnership with local Realtor boards and associations. The dollar volume of these sales totaled nearly $241 billion, which, because prices also swelled in 2021, represented an increase of more than 48%.

The statewide median sales price for single–family existing homes at year’s end was $348,000, up 20% from the previous year.

“There has been a lot of relocation activity into Florida,” said Stewart. “And it’s not uncommon to see this, but it seems like it has accelerated of late. People are moving here not only from up north, but also from California and other states, which should keep the housing market steady this year.”

When looking at housing demand, another positive trend is the potential return of international buyers, who have largely stayed on the sideline because of the pandemic travel restrictions. The Sunshine State’s No. 1 international market is Canada, followed by the United Kingdom and Germany.

Because of its growth, Marine Bank recently opened a new 5,000–square–foot operations center in Vero Beach and a loan–processing office in Port St. Lucie. It had a 3,000–square–foot operations center and outgrew it.

Bill Penney, Marine Bank’s president and CEO, also stated last year that he plans to expand operations into St. Lucie County and open two branches. Marine Bank currently has four locations — two in Vero Beach, one in Sebastian, and one in Melbourne.

Brick–and–mortar branches are the heart of community banking and part of what makes up the fabric of society in towns across the nation. While larger financial institutions are closing or consolidating branches, community banks are bucking that trend. As the same time, those local branches are embracing digital services to remain viable.

Penney took charge of Marine Bank in 2010 when he was named to his current position. He put the bank on a strategic path of growth, taking measured, conservative steps. His game plan for growth has proven successful. Marine Bank has expanded its lending capabilities, including U.S. Small Business Administration loans, and has extended its geographic footprint.

“We are fortunate to have a CEO like Bill Penney,” said Milton. “He’s very supportive and very hands–on in running the bank.”

“He’s a leader who genuinely cares about the Marine Bank employees,” said Stewart. “It’s always about the team. He’s one of us.”

Last year, Penney was named chairman–elect of the Florida Bankers Association. The Florida Bankers Association has more than 200 members and advocates on behalf of Florida banks and the industry. He has been active in that organization for more than a decade.

He is also part of the Brevard Zoo Legacy Campaign Cabinet committee that is raising money for the new Aquarium and Conservation Center to be built along the Banana River near Port Canaveral.

The Brevard Zoo kicked off the $100 million campaign Dec. 2. It aims to break ground on the campus project in 2024. The Aquarium and Conservation Center is seen as an economic development tool, creating jobs and helping uplift the region’s economy.

Penney was born and raised in West Palm Beach. He has lived in Vero Beach since 1984, when he worked for Barnett Bank. He joined Marine Bank in 2004 as chief lending officer.

Marine Bank provides financial resources to small businesses through commercial real estate loans, construction loans, commercial lines of credit, U.S. Small Business Administration loans, and U.S. Department of Agriculture loans. “In 2021, Marine Bank closed $109 million in commercial loans,” said Milton. “Those loans enabled 232 businesses to grow and create new jobs, including in Brevard County.”

“We are here for the community. We pride ourselves on providing out–of–the–box banking solutions for customers. Custom products make a difference for the customer, especially when it involves a loan. Local decisions, custom solutions, and top–notch service help drive our business, yet we offer the convenient services of a large institution,

including mobile banking, multiple surcharge–free ATMs, and robust cash–management services,” added Milton.

including mobile banking, multiple surcharge–free ATMs, and robust cash–management services,” added Milton.

Community banks have always focused on the needs of people and businesses in their towns. In fact, they fund 60% of the small business loans in the U.S. It’s that personal connection that helps banks be a part of their customer’s life events, such as a marriage, birth of a child, or buying their first home. “We are there for them every step of the way, providing personal service,” said Stewart.

Milton said when the phones ring at Marine Bank branches, they are answered by local people. The COVID pandemic has overloaded many financial institutions’ 1–800 lines, frustrating customers who are trying to get a “live person” on the line, only to hear the recorded words “higher–than–normal call volume.”

“When a customer calls Marine Bank, he or she will talk to a local individual at that particular branch. They will not be put through a phone maze. That’s the beauty of being a true community bank — local, local, local,” said Milton.

The newest commercial lender at the Melbourne branch is industry veteran Pedro Guirola. He has worked in the local market, in Orlando, and out of state with financial institutions. “Pedro knows the Brevard market very well,” said Milton. “It’s great to have him on our lending team.”

Commercial and multifamily mortgage originators anticipate 2022 to be another “strong” year of borrowing and lending, according to the Mortgage Bankers Association’s 2022 “Commercial Real Estate Finance Outlook Survey.” The survey was conducted between Dec. 1 and Dec. 15, 2021.

The survey highlights include:

- Lenders remain eager to make loans. All surveyed originators reported that in 2021, lenders had a “strong” or “very strong” appetite to make new loans, and all expect lenders’ appetite to be “strong” or “very strong” this year

- Borrowers are still eager to take out loans. All surveyed originators reported that borrowers had “strong” or “very strong” appetites to take out new loans last year, and 94 percent expect borrowers’ appetite this year to be “strong” or “very strong.”

Marine Bank’s residential lending team has been busy, too. Stewart said Marine Bank “closed $55 million in mortgage loans in 2021, which assisted 115 families with the purchase or refinance of their homes. The $55 million is the total production for our branch network.”

She added that Marine Bank has been focusing on construction–to–permanent loans. Also called a “single–close loan,” a construction–to–permanent loan is a special loan used to finance the cost of buying land, building a home on it, and later the loan serves as the mortgage on the home once construction is complete.

This kind of loan is great for borrowers who want to build a custom home on a chosen lot using contractors they pick,” said Stewart.

Normally, a customer would need two separate loans for these purposes: a construction loan to buy the land and build a home on it, and a separate mortgage loan to finance the finished home. “A construction–to–permanent loan accomplishes both goals,” she said.

Driven by strong buyer demand and the expectation of higher mortgage rates, new home sales ended the year reaching their highest level since March 2021, reports the National Association of Home Builders. Sales of newly built, single–family homes in December increased 11.9%.

The American Bankers Association’s Economic Advisory Committee released its 2022 forecast in mid January and the economists see 2022 as the year of “full employment.”

The committee, made up of 16 chief economists at large banks, expects the post–omicron economy to spur continued gains in employment, driving the unemployment rate lower. “We are knocking on the door of full employment,” the report says.

The bank economists expect the national unemployment rate to decline from 3.9 percent at present to 3.5 percent at year–end.

“The tight labor market continues to drive wage gains across all income segments, which will encourage more people to go back to work. More jobs with rising wages will ensure the consumer remains the bulwark of our economy in the year ahead,” according to the forecast.

The bank economists see business investment as the strongest component of the current rebound. The consensus forecast is for capital spending to grow about 5% in 2022, following nearly a 7% increase last year.

Vigorous home price increases are expected to continue, “driven by mortgage rates remaining low by historical standards, a dearth of housing stock, and resilient household incomes.” The bank economists predict the national average home price to rise about 7% this year.

“We’ve been talking to local Realtors and they think the housing market will continue to make gains in 2022,” said Stewart. “The Brevard market has been on a roll. It’s great to be working in a county that is growing and prospering.”